If it seems like the world is getting more expensive, that’s because it is. The cost of consumer goods is rising, according to the Bureau of Labor Statistics. But that doesn’t mean you have to give up on fun times just yet. There are still ways to live well in a higher-priced world. By using these strategies, you can keep more of your paycheck for yourself.

Just because something is really expensive right now, that doesn’t mean it will be in three months.

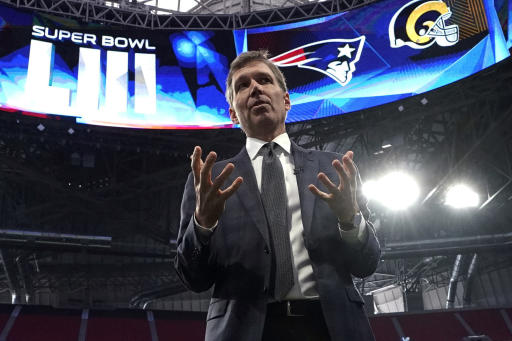

“Timing is everything when it comes to shopping,” said Jon Lal, founder and CEO of online coupon and cash-back website BeFrugal. “Time your purchases with the seasonality and popularity of items, and get it in the off-season or when stores have too much inventory.”

If you’re not taking advantage of a high-yield savings account, you are missing out on free money. When you’re putting money away for emergencies or big purchases, there’s no reason for you to not make the most of it.

By opening an account like PenFed’s Premium Online Savings Account, you can enjoy a 1.00% annual percentage yield1 that will earn you 16 times the national average2 while it sits. If you’re going to save money anyway, you should do it in the smartest way possible.

1APY (annual percentage yield) is accurate as of July 10, 2020, and is subject to change at any time. Fees may reduce earnings. $5 minimum to open account. Federally insured by NCUA.

Listening to music can actually make you happier, according to research from the University of Missouri. Fortunately, you don’t need to buy a bunch of new tunes. Instead, check out affordable music services like Spotify, where you can listen to tons of amazing music for free. Or, if you don’t want ads interrupting your happiness, a premium membership is just $9.99 a month.

A bike with rusted gears and a flat tire is not a bike — it’s a space-waster. And a car that never gets its oil changed is a major credit card expense waiting to happen. Remember, a little prevention can save you a major headache — and potentially reduce big expenses down the road.

Your time is valuable, so learn to say “no” to time-wasters. That’s advice Bill Gates said he got from Warren Buffett, who has the great habit of not letting his calendar fill up with useless meetings. If the meetings are mandatory, try other ways to feel more energized at work.

Whether it’s collecting stamps, taking photos or flying model planes, a hobby could make you happier. Although the science isn’t definitive, there are studies that show hobbies can improve cognitive ability. Better yet, there are plenty of hobbies that don’t require a lot of money, like running or learning a new language.

Studies show that regularly sleeping less than seven hours per night correlates with higher blood pressure, diabetes, obesity and depression. None of these are synonymous with living well, and all sound like issues that could cost you in the form of healthcare bills.

The price cut on refurbished items can be substantial, according to Consumer Reports. The site also cites an Accenture study that found that only 5% of returned electronics were actually defective, so you have a pretty good shot at scoring a virtually new laptop, TV or smartphone for a great price.

Instead of letting your (sometimes richer, sometimes less responsible) friends choose the spots for Friday night, be proactive and choose them first.

Find inexpensive places to grab that beer — it’ll taste the same whether you pay $4 or $12. You can also host a cheap but impressive dinner party at home.

For purchases over $50, or a limit you determine based on your budget, wait 24 hours to make sure you really want it and you’re getting a good deal.

“You should also use that time to sleep on the decision,” Lal said. “If it’s something you’re still thinking about after 24 hours, and you did your research, then it’s a decision you’re less likely to regret.”

Stop Now: 30 Money Mistakes You’re Probably Making This Summer

Walk More

A daily brisk walk can do everything from lift your mood and improve your coordination to help prevent heart disease and Type 2 diabetes, according to the Mayo Clinic. And if you can keep yourself happier and healthier, you can avoid some costly health issues.

To get the most out of your walk, invest in an inexpensive pedometer — there are plenty under $20 — or download a free weight-loss app.

Bring Your Lunch to Work

Ask yourself if you’d rather have those meals out with co-workers or if you’d rather have money in your pocket for your future. Then buy some lunch bags.

And then when you’re not paying for food out as much, you can put those savings to work by adding them to a high-yield account like the one from PenFed. Its APY will help you to grow your savings faster – a money move that will pay off in the long run.

Eat More Veggies

Protein is generally more expensive than plant-based foods, according to the U.S. Department of Agriculture, so going without it for a few dinners a week can help you save money for something more fun than pork.

Veggies are also healthy, so you might just feel better, too. There’s even a diet that advocates this: the Flexitarian diet. It could be your ticket to a healthier budget and self.

Stretch Every Morning

Don’t just simply reach for the sky as you yawn. Practicing yoga regularly provides a myriad of benefits, a Harvard Medical School review found, from improving body image to lowering blood pressure. Avoiding health issues can save you money in the long run.

Live Below Your Means

Spending less than what you make every month is tough, but usually doable. It also means less stress and more chances to take advantage of opportunities when they come up.

Try to cut your cost of living by following tips from frugal billionaire Warren Buffett, who is also perennially happy. You can do things like not overspend on items such as your cellphone or car.

Check Out: These Are the 50 Best Cities for Gen Z To Live Well on a Budget

Floss Every Day

There’s strong evidence that good oral health can help your overall health. Bacteria and inflammation due to gum disease can even lead to other diseases, according to the Mayo Clinic. Not to mention that dentist visits are expensive, so grab some floss.

Dress Up With Craigslist

You don’t have to spend top dollar to look like a million bucks. There are many ways to get designer clothes at a discount.

“If you love designer brands, but can’t afford the price tag, search for that designer’s name on Craigslist,” Lal said. “You’ll be surprised at what you can find in new or very good condition.”

Get a Massage

Sure, a massage might sound like an indulgence, but many massage schools offer massages at drastically reduced prices. By offering up your tired and knotted flesh for students to practice on, you can score a near hourlong massage for as little as $35. Start by finding a school near you through the American Massage Therapy Association.

Laugh More

Studies have shown that laughing has a wide range of health benefits. For instance, a Vanderbilt University study estimated you can burn up to 40 calories by laughing for 10 to 15 minutes a day, and a University of Maryland study found that having a sense of humor might help ward off heart disease.

Meditate Every Day

Just a few minutes a day of meditation could improve your life — and it’s one of the cheapest ways to invest in your health.

Meditation reduces anxiety and depression levels, according to a Johns Hopkins study. It also improves overall psychological well-being, according to a Harvard study.

Drowning in Debt? 18 Effective Ways To Tackle Your Budget

Eat More Slowly

It takes about 20 minutes from the time you start eating for the brain to signal fullness. When you eat too fast, you often eat too much, according to research presented at a meeting of the North American Association for the Study of Obesity. Eat more slowly and you might lose weight, feel better and reduce expenses on food. That’s a win-win-win.

Wake Up Earlier

Early risers feel healthier and happier than night owls, according to a study published by the American Psychological Association. Time to buy that alarm and set it nice and early.

Gossip More

You read it right. A little gossip can be a healthy thing. According to research from the University of Pavia in Italy, gossip increases levels of oxytocin, the same hormone released during sex. So go ahead — you can gossip a little without being mean about it. After all, if it keeps you happier and healthier, you’ll save in the long run.

Watch Less TV

TV can be a time-waster or worse. Some studies have suggested that watching a lot of TV — for example, three hours or more a day — can lead to premature death. It’s even been suggested that for people over age 25, each hour of watching TV equals 22 minutes less of life.

Use Your Credit Card Less

Credit cards have notoriously high interest rates and are difficult to pay down. Billionaires from Warren Buffett to Mark Cuban say to cut the plastic. If one of your goals is to build wealth, avoid going into debt with them.

Credit Cards: How To Use Your Credit Cards To Make Money — and To Save Money, Too

Drive a Smaller Car

Ask yourself if you really need that 6,000-pound SUV. A Toyota Prius with racks will get your surfboard, mountain bike or your kids to the fun just as well — and you can get up to triple the gas mileage doing it. That’s money you can spend on living better — or a new bike.

Don’t Compare Yourself to Others

Writing on how to live a better life, psychologist Thomas A. Richards pointed out that when you compare yourself to others, “you always tend to see yourself on the ‘short end’ and everyone else seems better.” That’s no way to live well. It might also lead to spending on things you don’t need in an effort to overcompensate. Don’t compare yourself to others, and you might just keep more money in your wallet.

Subscribe

If you want to try name-brand items without paying name-brand prices, consider signing up for subscription boxes, Lal said. It could be a great way to live well and reduce expenses, too.

“If you have room in your budget for a fixed cost each month, you can try tons of different wine, cosmetics, cheeses, coffee or clothing without paying the full price of each item,” he said. If you want to try new wines, for example, Wine Club Reviews is the best place to find a club to join.

Think Positive

Positive thinking builds your skill set, enhances your health and improves your work, according to positive professor and psychology researcher Barbara L. Fredrickson. That can lead to living better. Also: Positive thinking is free.

Plant a Garden

Gardens provide bigger benefits than just fresh veggies. Studies have found that gardening can reduce stress, improve mental health — including reducing the risk of dementia — and provide low-impact exercise. Plus, those veggies are really cheap and fresh.

And then with the money you save by growing your own food, you can add more to your high-yield savings account to grow your funds just like your veggies.

Be a Good Samaritan

If and when you get the chance, practice compassion. Practicing compassion helps you “enjoy better mental and physical health and speeds up recovery from disease,” and might even lengthen your lifespan, according to a University of California, Berkeley publication.

Cherish Your Friendships

Friendship doesn’t cost a penny, but it has many benefits that can enrich your life. Friendship boosts happiness while reducing stress and increases your sense of belonging, self-confidence and self-worth, according to the Mayo Clinic.

Spend On Experiences

You’ll get more happiness from going on vacation than buying a new couch, reports The New York Times. Research has found that, in general, spending money on experiences can bring more happiness than spending on more stuff. So take a vacation… from that new couch of yours.

Travel: Travel Experts Reveal the Best Ways To Save on Vacation

Volunteer

Giving your time to a cause can help more than the cause. Studies have shown that volunteering not only fends off loneliness and depression, but it can also offer better health, including lower blood pressure and a longer lifespan. So donate a little time, and you could get a lot back.

Spend Less on Haircuts

Just as with massages, barber and beauty schools often give great rates on haircuts and styling so their students can gain experience.

For example, L.A. Barber College offers men’s and women’s haircuts for just $8. This proves you can find great deals even in one of the most expensive places to live.

Make It Yourself

From toys and gifts to cosmetics and cleaning products, there are many costly items you could make yourself. It’s often not only less expensive, but it can even provide a great family project. And it’s all just a Google search away.

Make a Life Goals List

One way to enrich your life is to have a list of life to-dos: Anything from climbing Mount Everest to writing a book to getting a dog is fair game. Experts suggest making your goals specific and attainable, or failing might do more harm than good. Bucket-list items don’t have to be expensive, either.

Read a Good Novel

First of all, reading a book is one of the cheapest ways to entertain yourself. Second, research from Emory University has shown that reading a gripping novel actually creates new connections in the brain. That can only make your life richer.

Don’t Pay Full Price

There is a way to avoid paying full price for just about anything. For serious discounts, check out services like Groupon and Living Social, as well as sites like RetailMeNot, Offers.com, Coupon Sherpa, Coupons.com, Slickdeals and others.

Budget Your Happiness

Make a prioritized list of things you buy with discretionary spending each month, then cut the bottom three. You’ll have more to spend on the goodies and experiences you really love — or take that money and put it toward retirement.

Quit the Gym

Face it: You don’t use your gym as much as you should. With the average monthly cost of a gym membership above $50, according to Statistic Brain Research Institute, swapping the treadmill for the sidewalk and buying a few weights could be just as good for your wallet as it is for your heart rate.

Health: Things To Cut Out Right Now To Save Money During the Health Crisis

Quit Smoking

Since smoking cigarettes is so expensive — you can expect to pay at least $13 for a pack in New York City — going cold turkey could be beneficial to both your lifestyle and your life expectancy. Get serious about cutting this bad habit — and any other habits that are making you poor — and watch the savings roll in.

Use a Discount Cell Service

Major cellphone service providers have discount carriers that charge less for using the same towers. As long as you have a phone that works with them, you could seriously reduce expenses on your cell service.

Some sub-brands are Cricket (using AT&T), Boost Mobile (Sprint) and Total Wireless (Verizon). Finding ways to cut your cost of living can help you live well.

Entertain More

Going out can cost you serious money. An entire bottle of wine from Trader Joe’s is much cheaper than your first drink at a swanky club.

Dinner and a movie, on the other hand, is much less expensive on your big screen at home. Entertaining just twice a month rather than going out could save you hundreds by the end of the year.

Spend Time With Your Kids

We’ve all heard it: Kids want your time more than the stuff you can buy them. Children who talk to their parents regularly are happier than those who don’t, according to a study by the U.K.’s Office for National Statistics.

Trade Your Books

Most books are a one-time read. After that, they become bookcase dust collectors. So, trade them for other used books, either at a local bookstore or online at sites like PaperBack Swap.

Use Your Library

Libraries are a great resource not only for books but for digital books, audible books, magazines, DVDs and CDs, too. It’s one of the few places where you can get some of these items for free, so take advantage.

Buy Generic

Most informed consumers buy generic, according to a study by economists from Tilburg University in the Netherlands and the University of Chicago. For example, nine out of 10 pharmacists and doctors buy the generic version of aspirin, which can be as much as 80% less expensive. And, professional chefs prefer store-brand sugar, salt and baking powder to name brands.

“If it is food or a beauty product, take a look beforehand at the reviews and ingredients to make sure you’re not compromising on quality,” Lal said.

Ask About Company Benefits

You might think you’re taking advantage of all your work benefits, but people are often surprised to find they aren’t.

Some examples of work benefits you might be missing out on are prepaid legal, long-term care or tuition-reimbursement benefits. Ask your human resources manager to find out what else your employer offers.

Find Free Entertainment

From parades and music festivals in the park to lectures at the library and fireworks shows after dark, chances are your city offers a lot of free entertainment. And, some of it is actually good. Many museums also have “free to the public” days or discounted days. It can be a low-cost way to get some high culture.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 50 Easy Things You Should Do To Save Money